Guest Blog Post by Corey Rosen, Founder of the US National Centre for Employee Ownership .

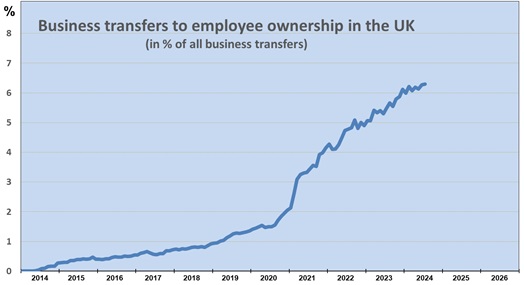

In 2014, the United Kingdom passed a law providing a tax exemption for business owners selling to an employee ownership trust (EOT). An EOT is somewhat similar to a U.S. ESOP, but unlike an ESOP, with an EOT the employees do not have individual share accounts and do not have any claim on equity when they leave the company. Instead, the trust is meant to own the company in perpetuity on behalf of the employees, with the employees getting a dividend or profit share each year. New data confirm just how successful this tax incentive has been in encouraging transfers to EOTs in the UK. According to the European Federation of Employed Shareholders, 1,756 UK companies have been transferred to their 124,000 employees via EOTs as of July 2024. About 6% of UK business transfers so far in 2024 have been through EOTs, as the graph shows.